When consumers run out of milk, hand soap, or paper towels, where do they go? Would it surprise you to learn that even now, in the digital age, they still turn to the corner store?

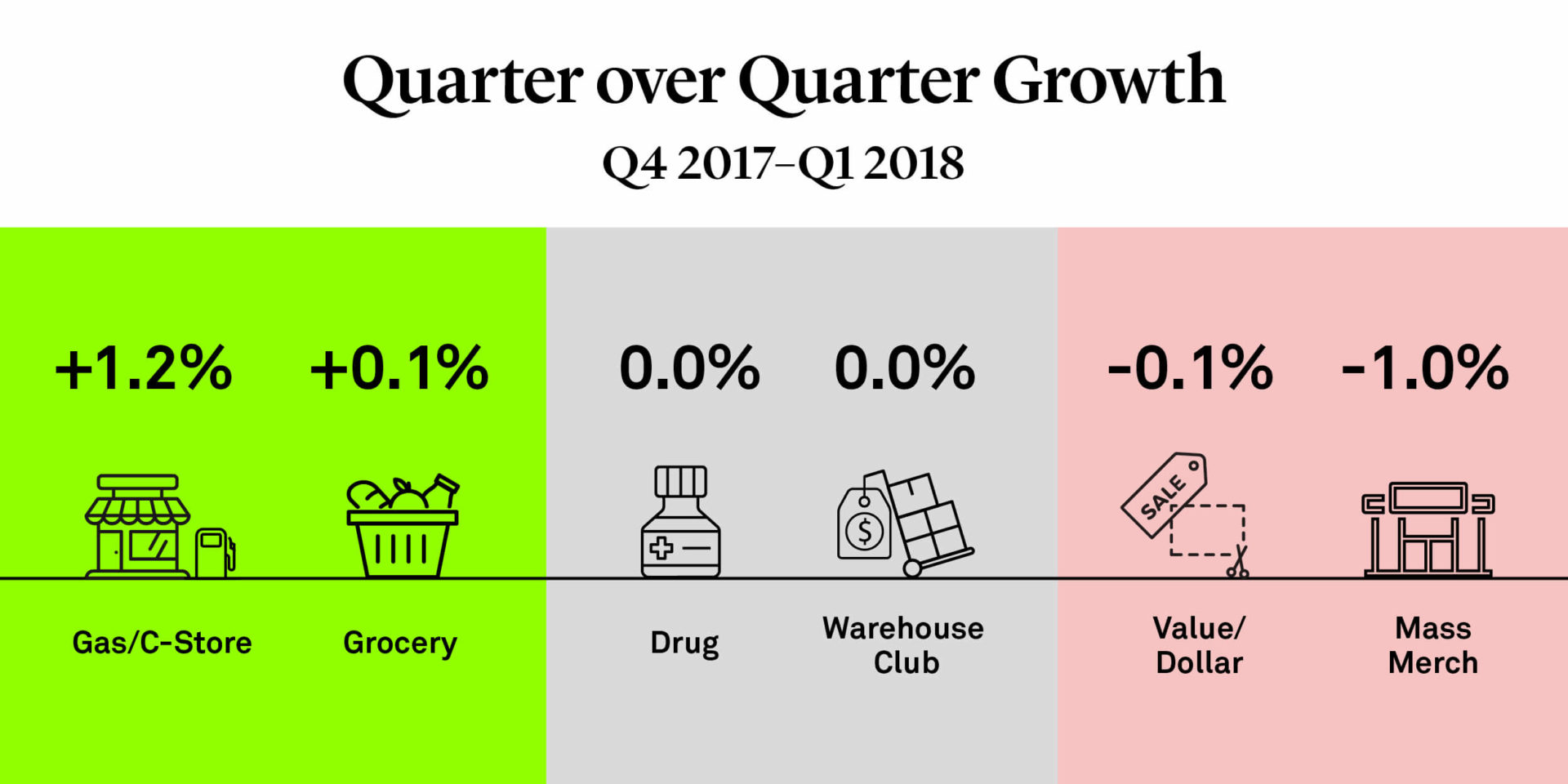

Despite the fact that Amazon ships health and household items of all kinds, and on-demand services deliver essential products to residents in many cities nationwide, convenience stores still remain a top choice for consumer packaged goods (CPG). The GroundTruth Q1 2018 CPG Foot Traffic Snapshot, which analyzes brick-and-mortar foot traffic, reveals that the C-Store channel saw the largest increase in share of foot traffic (1.2%) from Q4 2017 to Q1 2018 compared with Grocery, Drug, Club, Value/Dollar, and Mass Merchandise stores.

Why is this, and what are CPG brands doing to capitalize on the ongoing in-store opportunity?

Let’s take a closer look.

The Appeal of Convenience

C-stores, bodegas, mini-marts…whatever you call them, these retailers are a popular pick among consumers, for a number of reasons. The surge in foot traffic to convenience stores from Q4 to Q1 could be a product of the holidays. Once the holiday’s come to an end and shoppings busiest gift-giving season wraps up, traffic to Mass Merch stores tends to decline. Afterward, there’s still a need for the everyday essentials you can quickly grab at a C-store.

There’s much more to this trend, though. We know that consumers value convenience — especially Millennials. When CVS merged with Aetna earlier this year, our research into foot traffic patterns and survey data showed that 60% of Millennials cited proximity as the main reason they choose a pharmacy, while 45% cited convenience.

The appeal of convenience has been shaping retail for some time, prompting consumer behavior like showrooming and the creation of convenience-based services like Rent the Runway and Bonobos. Now, it’s poised to impact CPG as brands diversify to establish direct-to-consumer channels and brick-and-mortar stores.

In 12 Food Trends to Watch in 2018, CB Insights reports that CPG brands are starting their own distribution channels independent of grocers. Last year, Nestle invested in Direct-to-Consumer (DTC) meal delivery startup Freshly and acquired coffee chain Blue Bottle Coffee, thus providing it with additional points of sale across the country. It also opened a shop for its Nespresso brand.

At the same time, online businesses are recognizing the importance of having a presence in a physical store. Online meal kit service Blue Apron recently started selling its meals in Costco stores, while HelloFresh is making its meals available in supermarkets like Giant Food and Stop & Shop.

Location Comes First

The data in our Q1 2018 CPG Foot Traffic Snapshot also shows that for shoppers, location and convenience trump loyalty. Rather than shopping at one type of retailer for their consumer packaged goods, they consider their current needs and stock up someplace close.

Also driving this behavior is the desire to save money. Most consumers are looking for value, and they shop at multiple retailers to get the best deal. Our data shows that Mass Merch shoppers are the most likely to also visit Value/Dollar stores and Clubs, so in order to meet their customers’ needs it’s important for CPG brands to maintain a presence at a variety of physical retail stores. Overall, shoppers visit retail stores multiple times a month, logging 11.9 trips to Mass Merch stores, 11.1 to Grocery stores, and 8.9 to C-Stores, all in the name of convenience.

There will always be a place for physical locations that consumers can quickly visit to get whatever they need fast.

What our new foot traffic analytics data tells us about consumer trends behavior is this: While e-commerce has become a vital distribution channel and CPG investments in the on-demand market are on the rise, there will always be a place for physical locations that consumers can quickly visit to get whatever they need fast.

Interested in learning more about in-store visits, customer behavior, and the current retail landscape? Download our Q1 2018 CPG Foot Traffic Snapshot for all the latest foot traffic trends.