While foot traffic data has been known to uncover real-world consumer insights, most don’t realize how frequently it can align with actual brand performance and business trends—providing marketers with a deeper understanding into shopping behavior and future business success.

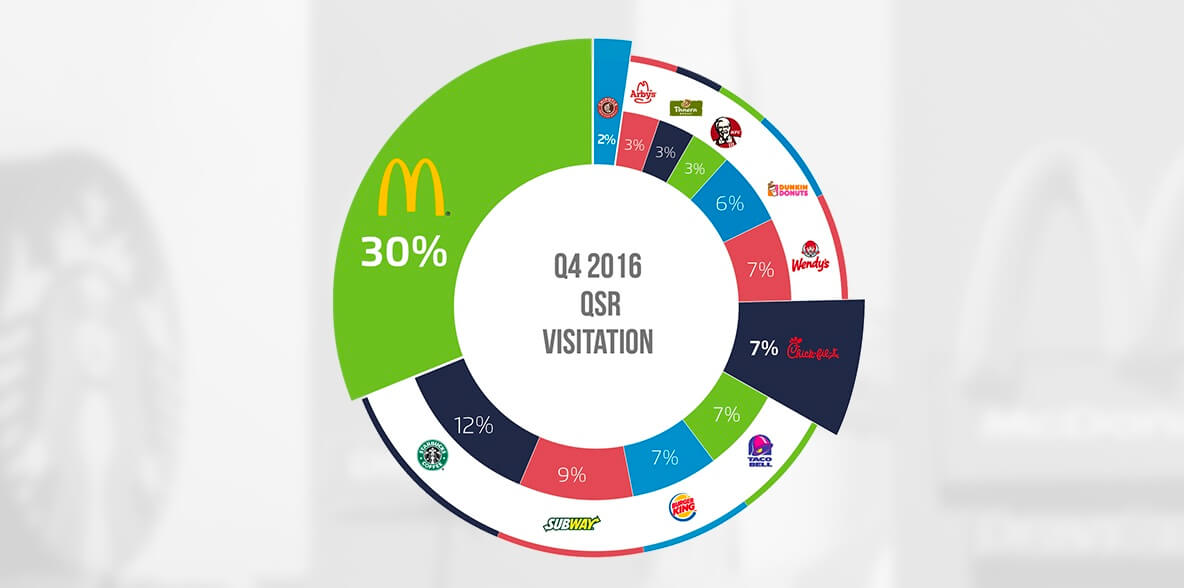

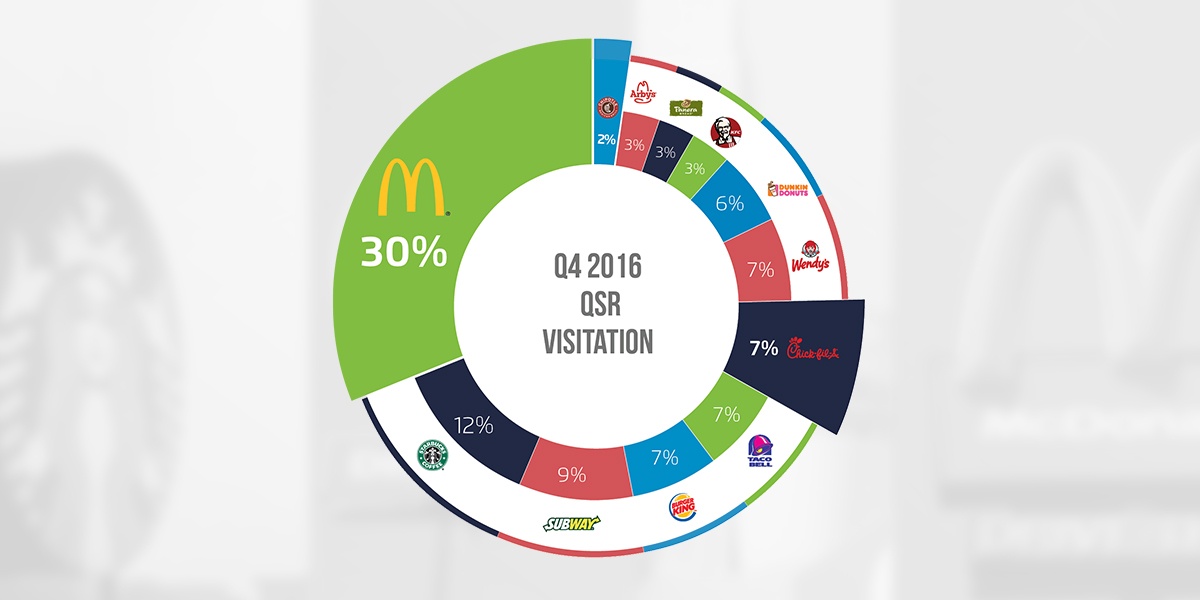

This is just one of the findings from xAd, which just released their QSR Foot Traffic report, which compares Quick Service Restaurant (QSR) foot traffic from Q3 to Q4 2016. Let’s take a look at four of the QSR brands that experienced shifts in visitation this quarter and what our data tells us about recent and upcoming business events.

Exploring New Territory: Chick-fil-A

Topping the list is Chick-fil-A, which saw a 2.6 percent increase in foot traffic in Q4 of last year. In line with what Business Insider reported in October, Chick-fil-A has been generating more per-restaurant revenue than any other U.S. QSR chain.

Analysts chalk this up to recent expansions into the Midwest and Northeast, including high profile locations in New York City, and the introduction of healthy new menu items, such as grain bowls. If Chick-fil-A continues along this same path, the uptick in its foot traffic could be here to stay.

King of Meats: Arby’s

Arby’s is another fast-food brand that did relatively well in Q4, with an increase in foot traffic of nearly 1 percent. What accounts for the change? Arby’s had a “meaty year” that put it several percentage points above the overall QSR industry in same-store sales growth. QSR Web notes that plans for more than 160 new locations, multiple new menu items, and a big improvement in QSR diner satisfaction all account for its recent foot traffic patterns.

The Comeback Kid: Chipotle

Chipotle Mexican Grill’s Q4 0.5 percent foot traffic increase was another step in the right direction for the brand that has been slowly increasing throughout the year, as noted by xAd earlier in the year. A report from Reuters suggests that December’s jump in sales was the high point of a disappointing quarter, but the chain is anticipating growth in 2017. The company plans to improve its customer service, unveil new menu items (including dessert!), and launch new digital ordering technology — all of which could boost foot traffic once more and help Chipotle leave its problems in the past.

Embracing The Future: McDonald’s

Although it’s usually a strong player, McDonald’s didn’t fare as well as usual in Q4. Interest in the chain’s recently expanded All Day Breakfast menu is, according to Crain’s Chicago Business, “waning,” and domestic same-store sales dropped 1.3 percent last quarter.

While this shift is reflected in our data, which showed a simultaneous 1.4 percent decrease in foot traffic, don’t count McDonald’s out of the game. As noted by Crain’s, while the brand is behind many of its competitors on the technology front — a fact that could be affecting its foot traffic as well — McDonald’s is currently preparing to expand its “Experience of the Future” concept by introducing table service and self-serve ordering kiosks in all of its U.S. stores.

Want more QSR insights and customer trends? Download the xAd QSR Foot Traffic Trends Report.